SAME DAY DELIVERY

AND HOW TO MAKE MONEY AT IT

By Terry Harris, Managing Partner, Chicago Consulting

WHY

Doesn’t it make sense? There’s lots of stuff we want soon, like today – that new high-tech gizmo, medicine we just took the last of, the how-to business book we plan reading tonight to get a leg up on the competition tomorrow. Ok, we don’t need everything today, but enough of us want “some things” today that it makes a market…a set of customers that want their stuff today badly enough to pay a little extra.

Consumers don’t plan; we’re impulsive. Needs crop up; out of the blue, randomly. At the B2B level, companies hate to carry inventory and supplies. Same Day Delivery and reducing lead-times in general are the same time-compression strategies that have driven much economic activity for decades. In some channels products are bought largely because they’re available immediately; witness all the impulse items in the grocery store check-out line.

In addition to serving this natural time-responsive need, Same Day Delivery is one more application of the market making proposition: If you built it, they will come!

AMAZON

It seems as though Amazon has stepped into Same Day Delivery in a significant way. The company is settling suits with States and will begin collecting additional sales taxes eliminating a price advantage that’s served them well. Then Amazon can have a physical presence in the State, put a warehouse near a metro area and provide Same Day Delivery from it.

Take Dallas, for example. Amazon has promised to add 2,500 jobs and spend $200 million in their tax settlement with Texas. They’ve announced two new facilities in California.

Amazon calls their Same Day Delivery service Local Express Delivery. It’s available in 10 cities—Boston, New York, Baltimore, Philadelphia, Washington D. C., Indianapolis, Chicago, Las Vegas, Phoenix and Seattle. Order cut-off times range between 7 and 11 AM. Notably absent on this list are Atlanta, Dallas and Los Angeles—all sizable markets.

Amazon provides Same Day Delivery for certain addresses and certain items only – obviously for items stocked in a nearby warehouse. They charge $8.99 plus $0.99 per item for a Same Day Delivery order.

That Amazon is willing to collect sales taxes and forgo its previous price advantage says a lot about their confidence in Same Day Delivery. They believe it will make up for the price hit plus the added cost and then some. How else could they justify it?

REQUIREMENTS

What’s it take to pull off Same Day Delivery? Here’s the list in order of difficulty starting with the easiest:

- Inventory It takes an on-hand inventory in a location—warehouse or, perhaps, a store—available to promise against random orders placed in the early part of the day on the internet by customers

- Fulfillment You have to pick on-hand items quickly, package them and get them outbound

- Delivery You need to transport orders to customers. Practically there are only two options:

- 1.A locker or “drop-box” It would receive orders and dispense them to customers coming by to pick-up their stuff

- 2.A carrier delivering to the customer’s address Curriers appear to be best organized to accomplish this

- Geography The inventory has to be “close” to the customer that ordered it. Perhaps 100 miles away is the limit.

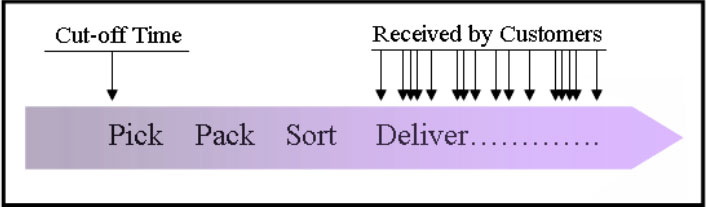

Here’s a generalized time-line at a location:

Inventory

We, as merchants, can identify those “some things” consumers will pay extra for – medicine, electronics, the baby’s diapers, the cool outfit she plans wearing to the party tonight? Actually, if we didn’t know what they were, it should be easy to figure out; just look at the fast movers. Identify the items customers previously paid extra for to get the next day. Some of those very same customers, and others, would have paid even more to get these items the Same Day!

Fulfillment

Many warehouses and some stores are nimble enough to process orders quickly now. Those that don’t may be able to make a few process changes in their existing facilities. The need for speed comes in the middle of the day, say from 9 AM to 1 PM – an under

utilized period in many facilities.

Delivery

A locker has to be well located—at a grocery store, convenience store or the like. They could be your stores if you have them, which may generate more traffic to shop for other merchandise.

However, the locker method inserts another business entity or location into the supply chain that would have to receive, hold and dispense individual orders. It’s slightly more complex than the delivery approach that gets the merchandise right to the customer’s desired address—home, office, workplace, whatever.

You would think the volume of shipments Amazon does with traditional parcel carriers would motivate them to invest in the resources needed to pull-off fast local delivery. If not many local curriers will jump at the chance to partner with an Amazon-like shipper. They’d pick up orders in the late morning or early afternoon at the shipper’s warehouse or store and make deliveries from there.

In New York City, for example, Amazon delivers through Dynamex, a well established currier service provider. In Times Square alone customers can choose from 20 nearby locker locations.

FedEx advertises its nascent Same Day service as available in 20 cities. Applicable Zip Codes are listed at this link http://images.fedex.com/us/services/pdf/ZipCodes_FSDC.pdf However, neither UPS nor FedEx deliver Same Day themselves. They sub-contract to curriers. UPS has invested $2 Million in a British-based service called Shutl with plans to enter the US market next year. Shutl is a web-based broker matching retailers and curriers for deliveries within hourly windows as soon as 90 minutes after placing an order.

There is not enough time to move parcels from a warehouse to a carrier’s facility, sort them there and wait for structured outbound routes. A currier goes door-to-door – they can pick up at the shipper’s location and bypass other facilities. Sorts into outbound

routes should be done in the warehouse and be based on each day’s order backlog at the cut-off time.

Geography – How Many Locations to Have and Where to Put Them.

So if geography is important, how many locations should you have and where should you put them? Well, clearly they should be “close” to your customers.

To illustrate this we’ll use the US population as an example customer pattern. For many merchants this is a good representation of their actual customer pattern. (If not, perhaps it should be!) In any case any pattern could be used. You could even use your competitors’ sales patterns and simulate the market you’d like to penetrate more.

To answer these positioning questions you need to place locations smartly, preferably “optimally.” You can’t put a warehouse in Montana and hope to serve much of the US population in the Same Day. You need a technology, a tool, to specify smart networks of different sizes – 1-location, 2-locations, 3, 4, 5, …and so on. This tool should place them optimally so that they are closest to customers.

We used our technology and found the first 30-location networks closest to customers represented by the population. For example, the optimal 10-location network is Northeast NJ, Miami FL, Lakeland FL, Gainesville GA, Chicago IL, Dallas TX, Denver CO, Alhambra CA, Tacoma WA and Oakland CA. On average it’s 184 miles and 1.04 days away from customers. No other 10-warehouse network is closer or quicker to customers. See https://www.chicago-consulting.com/ten-best-warehouse-networks-consultant-usa/

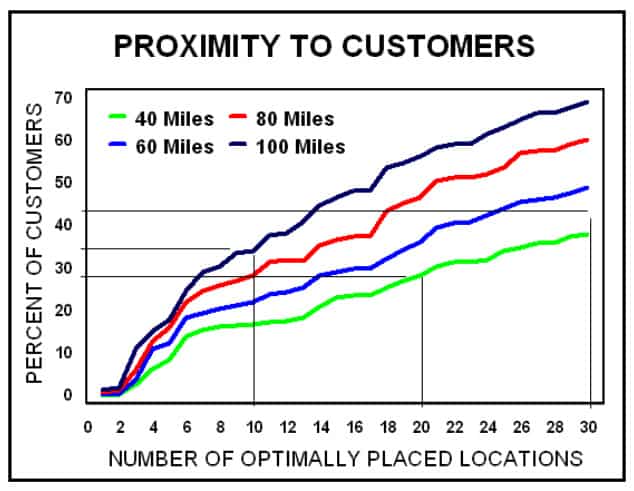

For these optimal networks the questions become: How many locations do we need? What fraction of our customers can we serve the Same Day?

We can answer these with the following chart :

– 34% of customers are within 100 miles of 10 optimally placed locations

– 20 optimally placed locations gets within 40 miles of 28% of customers

– It will take 30 optimally placed locations to get within 50 miles of 44% of customers

Accordingly a reasonable number of well placed locations serves a sizable portion of customers in the Same Day.

It’s likely that Amazon’s customers are more urban and less rural; that they are even more concentrated into denser metropolitan areas. This characteristic makes the percentage relationships even stronger for them and others with this urban focus—they’re able to serve an even bigger portion of their customers than specified in the purely population-driven results above.

ECONOMICS

The undiscounted UPS tariff prices a Zone 2 five pound package at $6.25 for Next Day Delivery. At Amazon’s $10 Same Day price it seems as though there’s enough money to cover costs and then some, leading the way to making money on Same Day Delivery shipping.

Beyond price, obviously shipping profitability will depend on how any Same Day system is designed—what delivery partners are used, how inventory performs, fulfillment details and so on. As with most supply chains, however, transportation costs will make or break

the economics of your Same Day system.

The volume of packages, orders, and their geographic concentration will play the defining role in the profitability of any Same Day system. It won’t work for a small number of geographically scattered orders. It will work for a number of orders that utilize a vehicle and driver delivering to a reasonably tight geography in the afternoon. The tighter the better. Of course, additional order volumes can be assigned to additional

routes making the outbound delivery that much more logistically efficient.

SELLING MORE

Not even covered above is the added advantage of selling more by providing Same Day service let alone the spill-over branding benefit to other parts of your business.

Consumers may be motivated to buy just because of Same Day when they wouldn’t have otherwise—the “grocery store check-out line” effect. Such is an enormous benefit; the margins earned on additional sales, likely 20 to 50%, will overwhelm any shipping profitability, probably 10 to 20%.

Is it plausible there’s a sales growth component at the individual consumer level too – that customers get “hooked” and shift their normal future purchases to Same Day once they’ve tasted its convenience? Do they buy even more than they would have otherwise? Has Amazon discovered these effects? They certainly have the data to do so.

In the abstract, none of us know Same Day’s price elasticity. How big will the sales lift be? We have to try it to get the answer; Amazon is.

Same Day Delivery compliments the comprehensive service-based strategy that’s fueled so much economic activity in the US and all other time-sensitive cultures. Driven by the sheer value of time, the one resource none of us have any control over, this historically cast trend will not abate soon, if ever.

What are you waiting for?

Terry Harris is Managing Partner of Chicago Consulting. There he designs supply chains for manufacturers, distributors and retailers fitting together components such as sourcing and inbound logistics, networks of plants and warehouses, inventory deployment, transportation, operations within warehouses and customer service.

He can be reached at terry@chicago-consulting.com or (312) 346-5080.