TOUGH TIMES–

10 Supply Chain Initiatives to

Survive and Thrive this Downturn

By Terry Harris, Managing Partner, Chicago Consulting

These are tough times. We don’t know how much worse they’ll get or how long they’ll last. Predicting the bottom is tricky. Still there are ways supply chain executives at manufacturers, distributors and retailers can survive and a few ways to thrive in this downturn. Here are 10 steps to help you tough-it-out.

1. Re-Design Your Warehouse Network, Add Regional Warehouses and Save Transportation Costs

Your transportation costs are very dependent on your warehouse network-how many you have and where they are located. You can reduce transportation costs by adding regional warehouses. Here’s how:

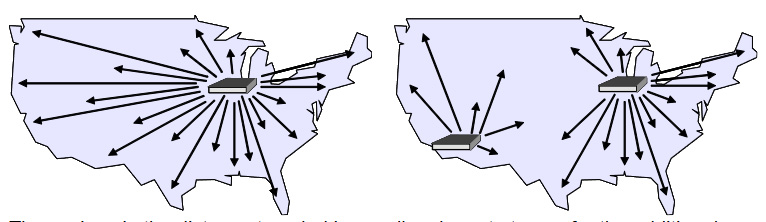

From one warehouse many shipments travel long distances. Add a regional warehouse and the total distance decreases.

The savings in the distance traveled is usually adequate to pay for the additional overhead of another regional warehouse and any replenishment to that warehouse. Of course, replenishments can usually take place more efficiently–TL rather than LTL, for example. The same principle applies in multiple warehouse networks-moving from three to four, six to seven and so on.

You can get a free warehouse network evaluation at : https://www.chicago-consulting.com/free-warehouse-network-evaluation-firm-usa/ It will tell you the best place to add a warehouse, the mileage you’d save and the consequences of eliminating any warehouses you have now.

An added dimension is the better service that more regional warehouses provide by decreasing transit lead-times. If this sells more to time-sensitive customers it is likely an even bigger benefit than the cost reduction.

2. Compete on Service, Fend Off Price Concessions

Your customers will evaluate their buying of your products in this downturn. They’ll place more demands on you and your competitors. Use this situation to compete on service rather than price.

Give your customers every reason to continue buying from you. Meet their service demands as inexpensively as possible. Beat competitors on important service components-availability, lead-times, and ease of doing business. Be flexible. Don’t give customers any reason to defect or buy from competitors.

Don’t wait for customers to ask you to cut your price. Be proactive. Meet with them first to explain what you’ll do to provide better service.

Sell your better service to competitors’ customers and switch them to you.

All the while way you must be attentive to the service your competitors provide. Do this to stay ahead of them and to pick up the pieces when they stumble–capture their customers; acquire them or their assets.

3. Re-Bid Your Freight Spend, Deepen Your Routing Guides

Shippers should routinely re-bid their freight spend in a comprehensive way. Some do it every three years, others more frequently.

Beyond it being good business practice, there are several reasons re-bidding bears fruit. Carriers’ patterns change. The carrier supplier market is dynamic and has undergone big change recently. Carriers will bid differently from one time to another.

Sophisticated shippers are continually in the market re-bidding some or all their freight. Here are a few tips

- Know your patterns. Document your moves by origin, destination, mode, cost, service level, season, day-of-week, and so on.

- Organize your bid request thoroughly. Make it complete and easy to understand.

- Shop lots of carriers. They have back-haul niches (or even front-hauls) they are trying to fill and will bid low to get them. You won’t find these niches unless you look for them.

- Analyze responses thoroughly. Quantify the service carriers will provide-equipment availability, reliability, certifications and so on.

- Negotiate with carriers based on volume commitments and other dimensions.

- Construct deep routing guides with priorities especially based on cost. More options are almost always better.

4. Invest in Non-Transportation Resources–Inventory, Labor, Technology, Time-That Offset Transportation

Cost Supply chains are full of tradeoffs between resources; resources such as capital, labor, facilities, inventory, technology and so on. Increase the scope of one resource and you can decrease the scope of others.

For years, between about 1980 and 2004, oil prices were low and they grew more slowly than other costs, especially labor and technology costs. Low fuel prices drove dramatic growth in costly parcel and fuel guzzling air transportation modes.

In this period many organizations balanced their resources at the “then” cost of each resource. Now, especially because oil and, consequently, transportation costs, have changed, your supply chain needs re-balancing.

For example, you can

- Provide more inventory availability to avoid abnormal shipments–out-of-territory, multiple shipments to complete an order, expedited modes

- Process orders quicker, use the time to bundle and pool freight

- Add technology to reduce out-of-balance costs

5. Fill Orders Flexibly

Flexible order fulfillment is a particularly effective way to achieve both cost reductions and service improvements. Let’s start with what not to do.

- Don’t ship one order from multiple locations Transportation economics motivate larger shipments. Whenever orders are split (300 pounds into 100 and 200 pounds or 1,000 pounds into 300 and 700 pounds) the total transportation costs go up.

- Don’t make multiple shipments of the same order Strive to ship the order complete by waiting until all items are available or include backordered items on the customers next order.

In both these cases you should try to ship an order once from one location, even if that location is further away from the customer.

You should get rid of fixed territories and ship orders flexibly. This means shipping orders based on costs and service. For example, large orders should likely come from plants, smaller orders from, say, a central DC and smaller still from regional DCs.

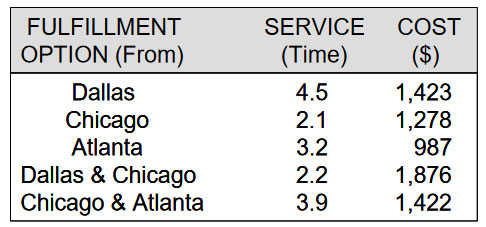

To generalize, smart companies evaluate the cost and service of fulfilling each order. They evaluate several options-from any warehouse or plant, split geographically, split in time, hold for completeness, so on. Here is an example format:

Having this capability they improve service and reduce costs over rigid static procedures and fixed territories.

6. Change Inventory Management Logic-Set Safety Stocks and Order Quantities Differently

Here are three different approaches:

• Make stocking/no-stock decisions and set Safety Stocks based on the cost of the item Few stocking strategies depend on the cost of the item. If they do it’s likely done at a gross level such as at the echelon or the A,B,C Class. Applying it to the lowest level of detail-the item/location-provides big benefits. The idea is to have high fill rates on fast moving inexpensive items and more guarded fill rates on slow expensive items–spark plugs versus re-built engines at a car dealer, for example. If you stock one less of a $100 item and one more each of five $10 items, your inventory will provide higher fill and you’ll have $50 to put in the bank.

• Change Push Deployment to Pull Plant-centric companies that push production quantities out through their supply chains have more inventory than Customer-centric ones that pull inventory based on demand. The Pull approach forces the whole supply chain to beat to the customer’s drum. What could be smarter?

• Smaller Order Quantities Buying and producing in smaller quantities will reduce inventory. This approach has historically encouraged many organizations to confront their set-up, changeover and acquisition costs. Huge savings have been made in these areas and more are available.

7. Accelerate Your Forecasts to Catch-up with Decreased Demand

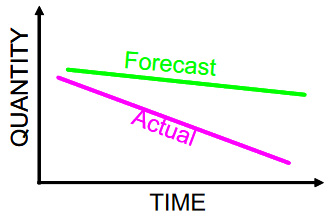

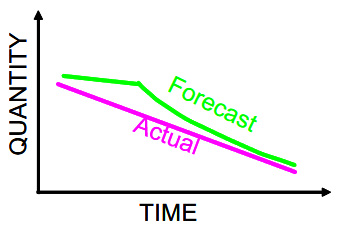

Any forecast based on historic demand will lag a trend. It looks like this:

This produces over-stated forecasts. Not what you want in a down market.

There are at least two ways to fix this. One is to make an adjustment to the forecast and then let it continue. It will look like this:

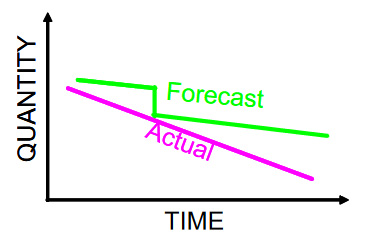

A second approach is to change “smoothing” constraints. Statistical forecasts that use historic demand have smoothing constraints. These are factors that blend immediate past demand with older past demand to make a forecast. They normally range between 5 and 15%. In down markets, raising these factors to 15 to 30% will make the forecast catch-up with actual demand faster. It will look like this:

8. Re-Engineer Packaging

Packaging has tentacles-tentacles that waste costs throughout supply chains. It goes further. Wasteful tentacles decrease customers’ efficiency too, causing increased costs in their supply chains and retail facilities. We need only look at our grocers’ shelves to see countless examples of wasteful packaging. Some of the largest CPG companies package their products wastefully.

There’s a new packaging technology called “Optimal Packaging.” It specifies package dimensions that require the least amount of material possible. You can apply this technology and test your package dimensions at https://www.chicago-consulting.com/optimal-packaging-designer-consultants-usa/ This technology can be applied to both consumer and case packages. Material savings between 10 and 25% are common.

Let’s look further, follow a tentacle. Packaging impacts how much can be put on a pallet, how much can be put on a truck, how much can be stored in a warehouse, how frequently pallets must be received, put away and retrieved–all this at manufacturers, distributors and retailers. It impacts sales per square foot in retail outlets. Bulky consumer packaging fills our home pantries. Needless air inside consumer packages tricks us into believing we’re buying more product than we are.

Account for these effects in your supply chain and your customers’ and you’ll save well beyond packaging’s traditional more narrow scope.

9. Shift to More Productive Transportation Modes–Expedited to Normal, Parcel to LTL, LTL To TL, TL To Rail, and Air to Ground

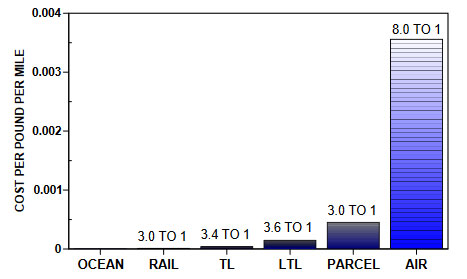

There are many transportation modes–Water, Ground, Air, Rail, TL, LTL, Parcel and so on. Productivity of these modes differs dramatically. In supply chains productivity can be measured by “cost per pound per mile”. Here’s the productivity of several modes:

The productivity of Air over Parcel is about 8 to 1. The productivity of LTL to TL is typically 3.6 to 1, and so on. With this perspective there’s strong motivation to shift to more productive modes.

This can be done in large segments–switch TL to Rail for West coast warehouse replenishments, for example–and in small increments–shipping an order to a customer that’s 100 miles away by ground rather than air.

10. Design Supply Chains and Position Products Around Green Sustainability

Few companies can ignore the green-sustainability movement; if for no other reason than their customers don’t ignore it. The LEEDs Standards affects the building materials industry and have been adopted by builders and large municipalities. Wal-Mart established its sustainability index and scores suppliers

against it. These adoptions by powerful buying organizations create supply chain opportunities in your company. Many follow suit.

Suppliers can exploit these standards by designing their supply chains and positioning products to them-to score high on these indexes. For example, packaging effectiveness counts for about 40% of Wal-Marts’ sustainability index. Positioning products to score high in this area of the index will differentiate them

from competitors’ products. You’ll have a competitive advantage and you may be able to establish exclusives with customers based on their own green scorecards.

Waiting for the bottom in this downturn is a losing survival strategy. Creating your own bottom with aggressive short-term cost reduction moves will help you survive and, just perhaps, to thrive.